Very bad day for your single currency, that on the currency markets is experiencing massive sales following the publication from the data on inflation within the euro area. In October, the index of consumer costs within the euro area stood at 0.7% with an annual basis, i.e. at levels well distant through the ECB’s target set at 2%. Moreover, the pace of inflation fell to its lowest level within the last 4 years. At this point you believe that deflationary pressures may push the Euro tower to think about new monetary policy strategies aimed at the increase involving supply.

The finance company in Frankfurt, led by Mario Draghi, could announce inside the next meeting a minimum of one new LTRO refinancing operation, to be able to further stimulate the credit within the euro area. The ECB could therefore consider expansionary monetary moves set up hypothesis of a new cut in rates of interest (from 0.5% to 0.25%) appears hard to achieve. Investors expect something from ECB, due to the fact the unemployment rate within the euro area is flown to its historical records of 12.2%. The consensus was steady in 12%.

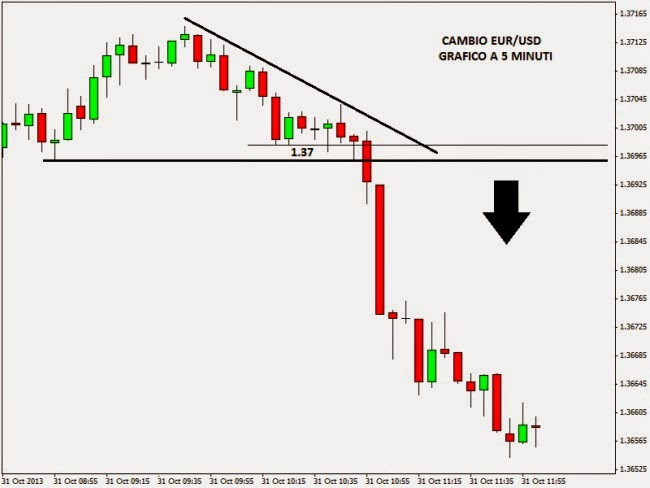

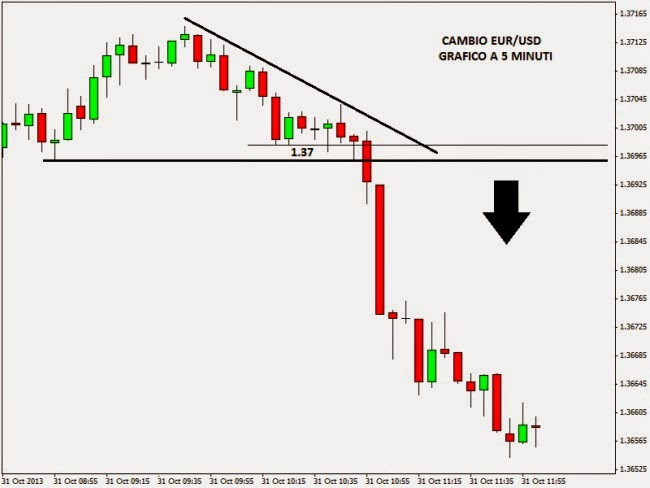

Within the currency markets, the euro / dollar exchange rate has lost 1.37 and has gone up to at least 1.3654, landing on a extremely important support zone. Any close below 1.3650 could cause a reversal of the better quality and push prices to 1.35. Sharp drop then for your euro / yen cross, which collapsed within the 134 area. The single currency has lost space against other currencies as well, like the pound, the Swiss franc and also the Australian dollar.

The finance company in Frankfurt, led by Mario Draghi, could announce inside the next meeting a minimum of one new LTRO refinancing operation, to be able to further stimulate the credit within the euro area. The ECB could therefore consider expansionary monetary moves set up hypothesis of a new cut in rates of interest (from 0.5% to 0.25%) appears hard to achieve. Investors expect something from ECB, due to the fact the unemployment rate within the euro area is flown to its historical records of 12.2%. The consensus was steady in 12%.

Within the currency markets, the euro / dollar exchange rate has lost 1.37 and has gone up to at least 1.3654, landing on a extremely important support zone. Any close below 1.3650 could cause a reversal of the better quality and push prices to 1.35. Sharp drop then for your euro / yen cross, which collapsed within the 134 area. The single currency has lost space against other currencies as well, like the pound, the Swiss franc and also the Australian dollar.

No comments:

Post a Comment