The forex (FX) market has numerous similarities to the stock markets; nevertheless, there are several key differences. This content will show you these differences and help you get initiated in forex trading.

Step#1: Picking a Broker

There are several forex brokers to choose from, simply as in any other market. Here are some points to look for:

Low Spreads; The spread, determined in "pips", is the distinction between the price at which usually a currency can be bought and the price at which it can be sold at any provided point in time. Forex brokers don't demand a commission, so this particular difference is how they make money. In evaluating brokers, you will discover that the distinction in spreads in forex is as excellent as the difference in commissions in the stock arena.

Bottom part line: Lower spreads conserve you money!

Step#2: Quality Organization

Unlike equity brokers, forex brokers are generally tied to large banks or lending organizations because of the large quantities of capital needed (leverage they need to provide). Also, forex brokers ought to be registered with the Futures Commission Merchant (FCM) and controlled by the Commodity Futures Trading Commission (CFTC). You can discover this and other financial information and data about a forex brokerage on its site or on the website of its parent company.

Bottom line: Make certain your broker is backed by a dependable institution!

Considerable Tools and Research - Forex brokers provide many different trading platforms regarding their clients - just like brokers in some other markets. These trading platforms often feature real-time charts, technological analysis resources, real-time news and data, and even assistance for trading systems. Before carrying out to any broker, be sure to ask for free trials to test different trading platforms. Brokers generally also provide technical and basic commentaries, economic calendars and other investigation.

Bottom line: Find a broker who will certainly give you what you require to succeed!

Step#3: Wide Range of Leverage Alternatives

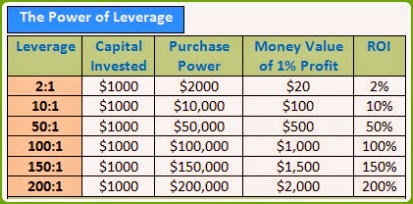

Leverage is required in forex simply because the price deviations (the sources of profit) are simply fractions of a cent. Leverage, indicated as a ratio between total capital accessible to actual capital, is the amount of money a broker will provide you for trading. For example, a ratio of 100:1 indicates your broker might lend you $100 for every $1 of actual capital. Many brokers offer as much as 250:1. Remember, lower leverage suggests lower risk of a margin call, however also lower bang for your buck (and vice-versa).

Bottom line: If you possess limited capital, make sure your broker provides high leverage. If capital is not a issue, any broker with a wide variety of leverage choices should do. A variety of choices lets you differ the amount of risk you are willing to take. For instance, less leverage (and therefore less risk) may be more suitable for highly volatile (exotic) currency pairs.

Step#4: Account Types

Many brokers provide two or more kinds of accounts. The littlest accounts is known as a mini account and needs you to trade with a minimum of, say, $250, offering a high quantity of leverage (which you require in order to make money with so little initial capital). The regular account lets you trade at a variety of various leverages, but it requires a minimum initial funds of $2,000. Finally, premium accounts, which often require substantial amounts of capital, let you utilize different quantities of leverage and often offer extra tools and services.

Bottom line: Make sure the broker you select has the right leverage, tools, as well as services comparative to your amount of capital.

Step#5: Things To Avoid

Sniping or Hunting - Sniping and hunting - or prematurely buying or selling near preset points - are shady acts committed by brokers to increase profits. Obviously, no broker admits to committing these acts, but a notion that a broker has practiced sniping or hunting is commonly believed to be true. Unfortunately, the only way to determine which brokers do this and which brokers don't is to talk to fellow traders. There is no blacklist or organization that reports such activity.

Bottom line: Talk to others in person or visit online discussion forums to find out who is an honest broker.

Step#6: Strict Margin Rules

When you are trading with borrowed money, your broker has a say in how much risk you take. As such, your broker can buy or sell at its discretion, which can be a bad thing for you. Let\'s say you have a margin account, and your position takes a dive before rebounding to all-time highs. Well, even if you have enough cash to cover, some brokers will liquidate your position on a margin call at that low. This action on their part can cost you dearly.

Bottom line: Again, talk to others in person or visit online discussion forums to find out who the honest brokers are.

Signing up for a forex account is much the same as getting an equity account. The only major difference is that, for forex accounts, you are required to sign a margin agreement. This agreement states that you are trading with borrowed money, and, as such, the brokerage has the right to interfere with your trades to protect its interests. Once you sign up, simply fund your account, and you\'ll be ready to trade!

Define a Basic Forex Strategy

Technical analysis and fundamental analysis are the two basic genres of strategy in the forex market - just like in the equity markets. But technical analysis is by far the most common strategy used by individual forex traders. Here is a brief overview of both forms of analysis and how they apply to forex:

Step#7: Fundamental Analysis

If you think it's difficult to value one company, try valuing a whole country! Fundamental analysis in the forex market is often very complex, and it's usually used only to predict long-term trends; however, some traders do trade short term strictly on news releases. There are many different fundamental indicators of currency values released at many different times. Here are a few:

Non-farm Payrolls

Purchasing Managers Index (PMI)

Consumer Price Index (CPI)

Retail Sales

Durable Goods

Now, these reports are not the only fundamental factors to watch. There are also several meetings from which come quotes and commentary that can affect markets just as much as any report. These meetings are often called to discuss interest rates, inflation, and other issues that affect currency valuations. Even changes in wording when addressing certain issues - the Federal Reserve chairman's comments on interest rates, for example - can cause market volatility. Two important meetings to watch are the Federal Open Market Committee and Humphrey Hawkins Hearings.

Simply reading the reports and examining the commentary can help forex fundamental analysts gain a better understanding of long-term market trends and allow short-term traders to profit from extraordinary happenings. If you choose to follow a fundamental strategy, be sure to keep an economic calendar handy at all times so you know when these reports are released. Your broker may also provide real-time access to such information.

Step#8: Technical Analysis

Like their counterparts in the equity markets, technical analysts of the forex analyze price trends. The only key difference between technical analysis in forex and technical analysis in equities is the time frame: forex markets are open 24 hours a day. As a result, some forms of technical analysis that factor in time must be modified to work with the 24-hour forex market. These are some of the most common forms of technical analysis used in forex:

The Elliott Waves

Fibonacci studies

Parabolic SAR

Pivot points

Many technical analysts combine technical studies to make more accurate predictions. (The most common is combining the Fibonacci studies with Elliott Waves.) Others create trading systems to repeatedly locate similar buying and selling conditions.

Step#9: Finding Your Strategy

Most successful traders develop a strategy and perfect it over time. Some people focus on one particular study or calculation, while others use broad spectrum analysis to determine their trades. Most experts suggest trying a combination of both fundamental and technical analysis, with which you can make long-term projections and also determine entry and exit points. But in the end, it is the individual trader who needs to decide what works best for him or her (most often through trial and error).

Step#10: Things to Remember

Open a demo account and paper trade until you can make a consistent profit - Many people jump into the forex market and quickly lose a lot of money (because of leverage). It is important to take your time and learn to trade properly before committing capital. The best way to learn is by doing!

Trade without emotion: Don't keep "mental" stop-loss points if you don\'t have the ability to execute them on time. Always set your stop-loss and take-profit points to execute automatically, and don't change them unless absolutely necessary. Make your decisions and stick to them!

The trend is your friend: If you go against the trend, you had better have a good reason. Because the forex market tends to trend more than move sideways, you have a higher chance of success in trading with the trend.

The Bottom Line: The forex market is the largest market in the world, and individuals are becoming increasingly interested in it. But before you begin trading it, be sure your broker meets certain criteria, and take the time to find a trading strategy that works for you. Remember, the best way to learn to trade forex is to open up a demo account and try it out. (Ready to try forex trading without risking your money? Check out our FREE Forex Trading Simulator)

Step#1: Picking a Broker

There are several forex brokers to choose from, simply as in any other market. Here are some points to look for:

Low Spreads; The spread, determined in "pips", is the distinction between the price at which usually a currency can be bought and the price at which it can be sold at any provided point in time. Forex brokers don't demand a commission, so this particular difference is how they make money. In evaluating brokers, you will discover that the distinction in spreads in forex is as excellent as the difference in commissions in the stock arena.

Bottom part line: Lower spreads conserve you money!

Step#2: Quality Organization

Unlike equity brokers, forex brokers are generally tied to large banks or lending organizations because of the large quantities of capital needed (leverage they need to provide). Also, forex brokers ought to be registered with the Futures Commission Merchant (FCM) and controlled by the Commodity Futures Trading Commission (CFTC). You can discover this and other financial information and data about a forex brokerage on its site or on the website of its parent company.

Bottom line: Make certain your broker is backed by a dependable institution!

Considerable Tools and Research - Forex brokers provide many different trading platforms regarding their clients - just like brokers in some other markets. These trading platforms often feature real-time charts, technological analysis resources, real-time news and data, and even assistance for trading systems. Before carrying out to any broker, be sure to ask for free trials to test different trading platforms. Brokers generally also provide technical and basic commentaries, economic calendars and other investigation.

Bottom line: Find a broker who will certainly give you what you require to succeed!

Step#3: Wide Range of Leverage Alternatives

Leverage is required in forex simply because the price deviations (the sources of profit) are simply fractions of a cent. Leverage, indicated as a ratio between total capital accessible to actual capital, is the amount of money a broker will provide you for trading. For example, a ratio of 100:1 indicates your broker might lend you $100 for every $1 of actual capital. Many brokers offer as much as 250:1. Remember, lower leverage suggests lower risk of a margin call, however also lower bang for your buck (and vice-versa).

Bottom line: If you possess limited capital, make sure your broker provides high leverage. If capital is not a issue, any broker with a wide variety of leverage choices should do. A variety of choices lets you differ the amount of risk you are willing to take. For instance, less leverage (and therefore less risk) may be more suitable for highly volatile (exotic) currency pairs.

Step#4: Account Types

Many brokers provide two or more kinds of accounts. The littlest accounts is known as a mini account and needs you to trade with a minimum of, say, $250, offering a high quantity of leverage (which you require in order to make money with so little initial capital). The regular account lets you trade at a variety of various leverages, but it requires a minimum initial funds of $2,000. Finally, premium accounts, which often require substantial amounts of capital, let you utilize different quantities of leverage and often offer extra tools and services.

Bottom line: Make sure the broker you select has the right leverage, tools, as well as services comparative to your amount of capital.

Step#5: Things To Avoid

Sniping or Hunting - Sniping and hunting - or prematurely buying or selling near preset points - are shady acts committed by brokers to increase profits. Obviously, no broker admits to committing these acts, but a notion that a broker has practiced sniping or hunting is commonly believed to be true. Unfortunately, the only way to determine which brokers do this and which brokers don't is to talk to fellow traders. There is no blacklist or organization that reports such activity.

Bottom line: Talk to others in person or visit online discussion forums to find out who is an honest broker.

Step#6: Strict Margin Rules

When you are trading with borrowed money, your broker has a say in how much risk you take. As such, your broker can buy or sell at its discretion, which can be a bad thing for you. Let\'s say you have a margin account, and your position takes a dive before rebounding to all-time highs. Well, even if you have enough cash to cover, some brokers will liquidate your position on a margin call at that low. This action on their part can cost you dearly.

Bottom line: Again, talk to others in person or visit online discussion forums to find out who the honest brokers are.

Signing up for a forex account is much the same as getting an equity account. The only major difference is that, for forex accounts, you are required to sign a margin agreement. This agreement states that you are trading with borrowed money, and, as such, the brokerage has the right to interfere with your trades to protect its interests. Once you sign up, simply fund your account, and you\'ll be ready to trade!

Define a Basic Forex Strategy

Technical analysis and fundamental analysis are the two basic genres of strategy in the forex market - just like in the equity markets. But technical analysis is by far the most common strategy used by individual forex traders. Here is a brief overview of both forms of analysis and how they apply to forex:

Step#7: Fundamental Analysis

If you think it's difficult to value one company, try valuing a whole country! Fundamental analysis in the forex market is often very complex, and it's usually used only to predict long-term trends; however, some traders do trade short term strictly on news releases. There are many different fundamental indicators of currency values released at many different times. Here are a few:

Non-farm Payrolls

Purchasing Managers Index (PMI)

Consumer Price Index (CPI)

Retail Sales

Durable Goods

Now, these reports are not the only fundamental factors to watch. There are also several meetings from which come quotes and commentary that can affect markets just as much as any report. These meetings are often called to discuss interest rates, inflation, and other issues that affect currency valuations. Even changes in wording when addressing certain issues - the Federal Reserve chairman's comments on interest rates, for example - can cause market volatility. Two important meetings to watch are the Federal Open Market Committee and Humphrey Hawkins Hearings.

Simply reading the reports and examining the commentary can help forex fundamental analysts gain a better understanding of long-term market trends and allow short-term traders to profit from extraordinary happenings. If you choose to follow a fundamental strategy, be sure to keep an economic calendar handy at all times so you know when these reports are released. Your broker may also provide real-time access to such information.

Step#8: Technical Analysis

Like their counterparts in the equity markets, technical analysts of the forex analyze price trends. The only key difference between technical analysis in forex and technical analysis in equities is the time frame: forex markets are open 24 hours a day. As a result, some forms of technical analysis that factor in time must be modified to work with the 24-hour forex market. These are some of the most common forms of technical analysis used in forex:

The Elliott Waves

Fibonacci studies

Parabolic SAR

Pivot points

Many technical analysts combine technical studies to make more accurate predictions. (The most common is combining the Fibonacci studies with Elliott Waves.) Others create trading systems to repeatedly locate similar buying and selling conditions.

Step#9: Finding Your Strategy

Most successful traders develop a strategy and perfect it over time. Some people focus on one particular study or calculation, while others use broad spectrum analysis to determine their trades. Most experts suggest trying a combination of both fundamental and technical analysis, with which you can make long-term projections and also determine entry and exit points. But in the end, it is the individual trader who needs to decide what works best for him or her (most often through trial and error).

Step#10: Things to Remember

Open a demo account and paper trade until you can make a consistent profit - Many people jump into the forex market and quickly lose a lot of money (because of leverage). It is important to take your time and learn to trade properly before committing capital. The best way to learn is by doing!

Trade without emotion: Don't keep "mental" stop-loss points if you don\'t have the ability to execute them on time. Always set your stop-loss and take-profit points to execute automatically, and don't change them unless absolutely necessary. Make your decisions and stick to them!

The trend is your friend: If you go against the trend, you had better have a good reason. Because the forex market tends to trend more than move sideways, you have a higher chance of success in trading with the trend.

The Bottom Line: The forex market is the largest market in the world, and individuals are becoming increasingly interested in it. But before you begin trading it, be sure your broker meets certain criteria, and take the time to find a trading strategy that works for you. Remember, the best way to learn to trade forex is to open up a demo account and try it out. (Ready to try forex trading without risking your money? Check out our FREE Forex Trading Simulator)